indiana excise tax alcohol

In order to use INtax for alcohol taxes you must have an Indiana taxpayer identification number TID and an access code provided by the Indiana Department of Revenue DOR. Bond Bank Indiana.

Motor Fuel Taxes Urban Institute

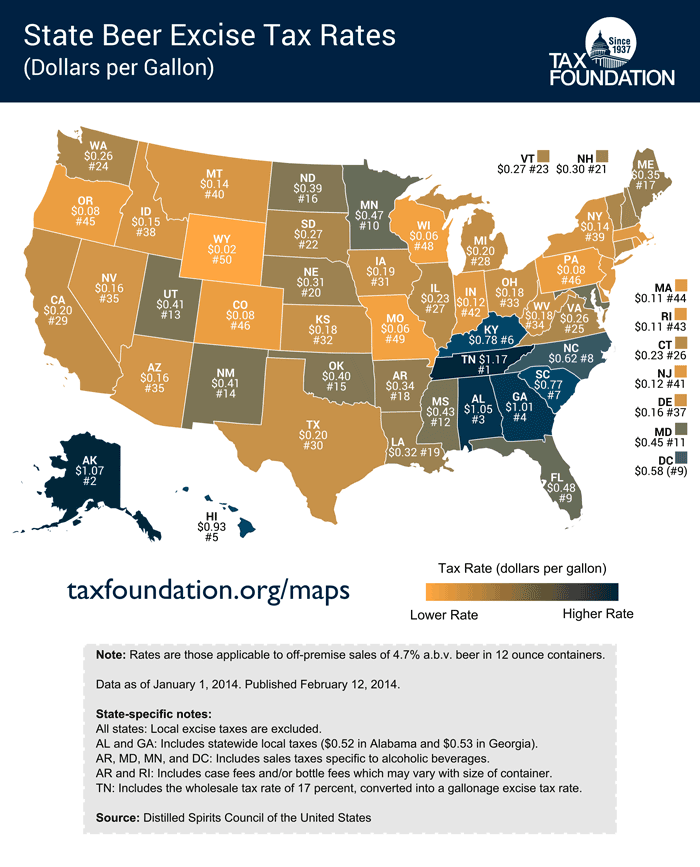

Case andor bottle fees which can vary based.

. State Excise police officers are empowered by statute to enforce the laws and rules of the Alcohol Tobacco Commission as well as the laws of the State of Indiana. An excise tax is a tax imposed on a specific good or activity. Additionally the bill would raise the tax on Indianapolis hotel stays to 17 the highest.

Gross Alcohol Tax Due. And for wine the pay an extra 47 cents. Indiana Alcoholic Beverage Permit Numbers Section B.

What is excise tax. Indiana 047 wine with an ABV over 21 is 268 Iowa 175 wine with an ABV under 5 is 0. As of January 1 2020 the current federal alcohol excise tax rates are.

Follow New articles New articles and comments. Gallons Received During Reporting Month from. In Indiana liquor vendors are responsible for paying a state excise tax of 268 per gallon plus Federal excise taxes for all liquor sold.

Collection Allowance for Timely Payment. Supporting Schedule to be filed with Monthly Excise Tax Return ALC-DWS-S Indiana Sales Use Tax ST-103 Instructions form mailed to taxpayer. Indiana Alcoholic Beverage Permit Numbers Section B.

For beer they pay an extra 11 and one-half cents. When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. Its 7 in Indiana.

This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would tack 25-cents onto a case of beer and 10-cents to a bottle of wine. The permit must be obtained- The state charges 50. House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100.

Missouri taxes are the next lightest at 200 a gallon followed by Colorado 228 Texas 240 and Kansas 250. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. IC 71-3-26 Direct Wine Sellers Permit.

3 rows Indiana Liquor Tax - 268 gallon. House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100. Multiply Line 7 by 010 or 5 whichever is greater.

Our mission is to provide quality service and to protect the morals and welfare. Under the permit the rules are as follows. Gasoline Use Tax First Filing Fuel.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services. Alcohol. Gallons Withdrawn for Sale or Gift in Indiana.

Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. A tax rate of 270 per proof gallon on the first 100000 proof gallons in production. Excise taxes also commonly referred to as sin taxes are taxes imposed on specific goods services and activities on a wide variety of those involved in the supply chain such as the manufacturer retailer or consumers.

Auditor of State. Indiana Liquor Tax - 268 gallon. Authorized by the Indiana Department of Revenue.

This brings your taxable selling price down to 13000 and you will owe 910 in sales tax 13000 7. Indianas general sales tax of 7 also applies to the purchase of liquor. Ethics Commission Indiana State.

Motor Fuel - MFT. The price of all motor fuel sold in Indiana also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. A tax rate of 1334 per proof gallon for the next 22130000 proof gallons in production.

State law permits the sale of alcohol from 7 am. Charity Gaming Card Excise Tax Return. The state charges a 7 sales tax on the total car price at the moment of registration.

Apply for employment as an Indiana State Excise Police officer. 830 am - 430 pm. Special Fuel - SFT.

In Indiana liquor vendors are responsible for paying a state excise tax of 268 per gallon plus Federal excise taxes for all liquor sold. What is excise tax on a car in Indiana. Visit Electronic Filing for Alcohol Taxpayers for filing information.

But if the wine has over 21 alcohol the extra tax jumps to 268. Beer wine and spirits are all subject to sales tax. Gasoline Use Tax - GUT.

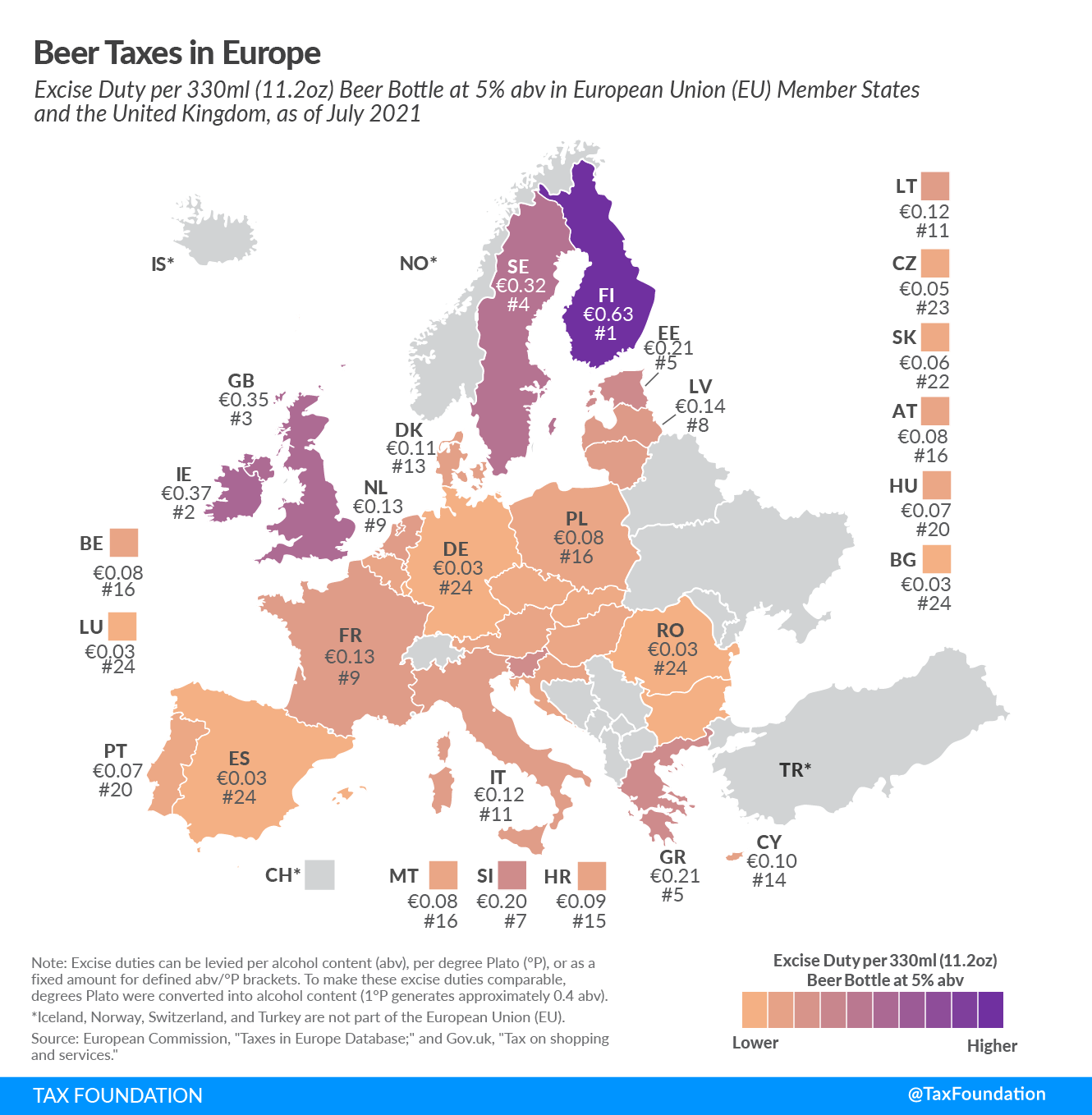

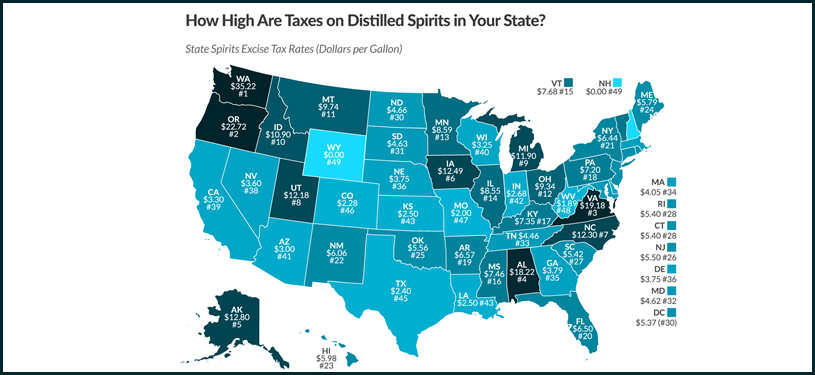

Like many excise taxes the treatment of spirits varies widely across the states. Multiply Line 5 by the tax rate in each column. Direct Wine Sellers Excise Tax Report.

Excise Police Indiana State 10 Articles. Other Tobacco Products - OTP. Taxes Finance.

If you do not have a TID please call 317 615-2710 to obtain both your TID. Gallons Returned to Manufacturer from Schedule ALC-M-S. An excise tax rate of 1350 per proof gallon for production in excess of 22230000 proof gallons.

Indiana Liquor Tax 268 gallon Indianas general sales tax of 7 also applies to the purchase of liquor. You can obtain a temporary beer and wine permit. You can hire a caterer who has a 2-way or a 3-way license.

The caterer must order supply distribute and pay taxes on the beverages. Monthly Excise Tax Return for Indiana-based Farm Wineries. Spirits excise rates may include a wholesale tax rate converted to a gallonage excise tax rate.

INtax Indianas free online tool to manage business tax obligations includes alcohol taxes. School for the Deaf Indiana. Transporter Tax - TRP.

Add Line 6 amounts from all columns. Indiana Alcohol Tobacco Commission Indiana Government Center South 302 W Washington St RM E114 Indianapolis IN 46204-2740 Phone. Under 15 047gallon.

Tax-exempt Gallons Sold from Schedule ALC-M-S Transaction Type A. However hours for carryout alcohol sales from liquor stores groceries pharmacies and convenience stores is. Multiply Line 7 by 0015.

Monthly Excise Tax Return for Indiana-based Breweries Distillers Rectifiers and vintners. Vehicle Sharing Excise Tax - VSE. Federal excise tax rates on various motor fuel products are as follows.

Beginning July 7 2022 no new registrations will. The paper forms with instructions shown below are available so customers can visualize what is required. And hire a licensed bartender.

The Indiana State Excise Police is the law enforcement division of the Alcohol Tobacco Commission. Building A 2nd Floor 2293 North Main Street Crown Point IN 46307 Phone. Aviation Fuel AVF.

Budget Agency State.

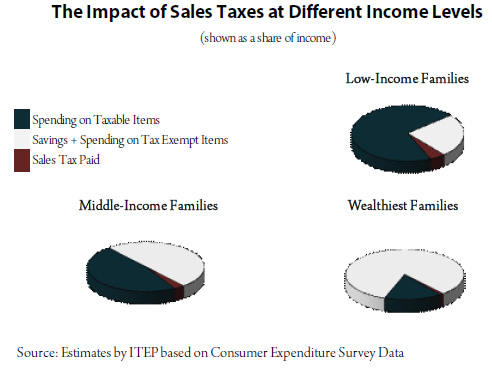

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

State Alcohol Excise Tax Rates Tax Policy Center

What States Have The Highest Alcohol Excise Taxes Alcohol Taxes Explained Diy Distilling

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

These States Have The Highest And Lowest Alcohol Taxes

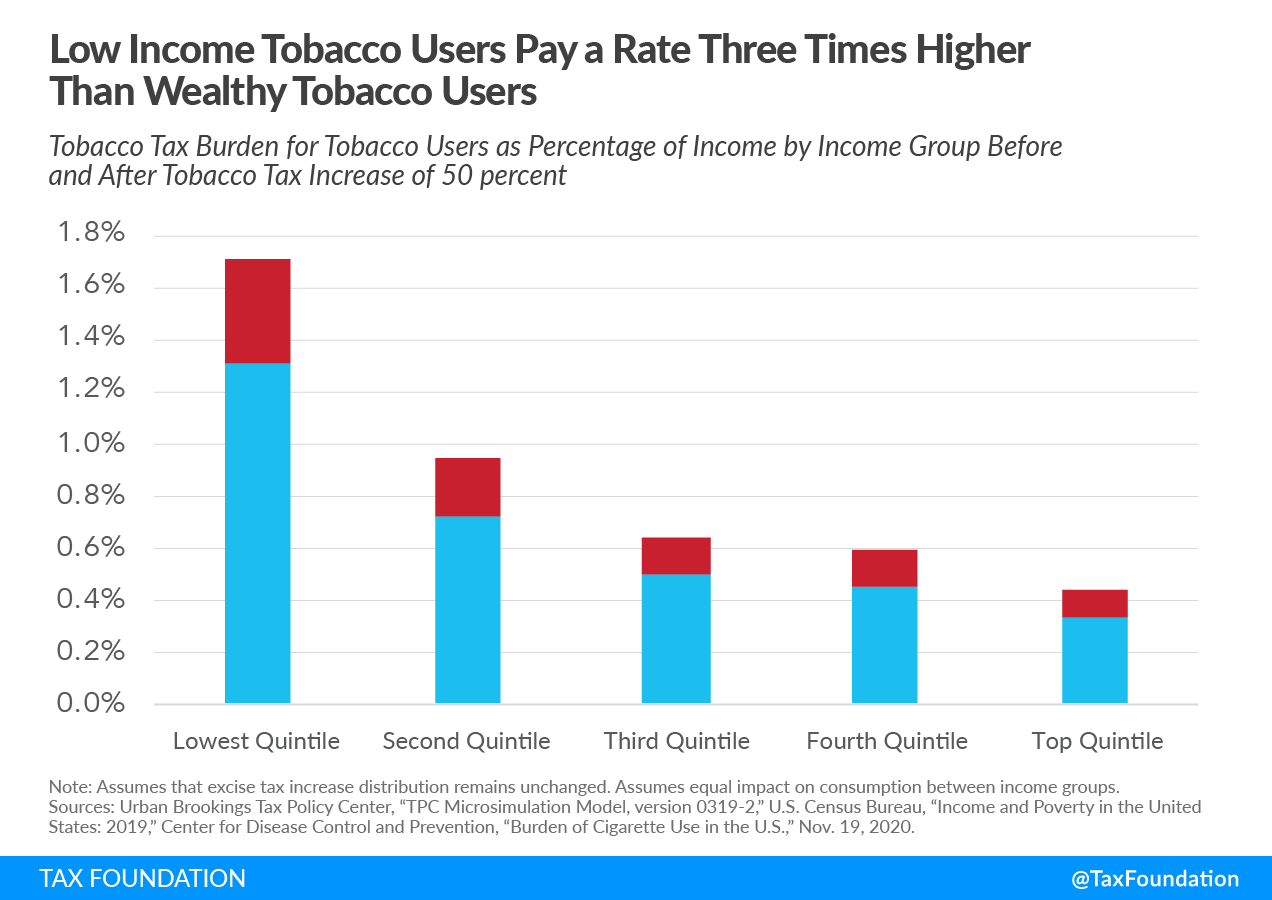

How Sales And Excise Taxes Work Itep

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

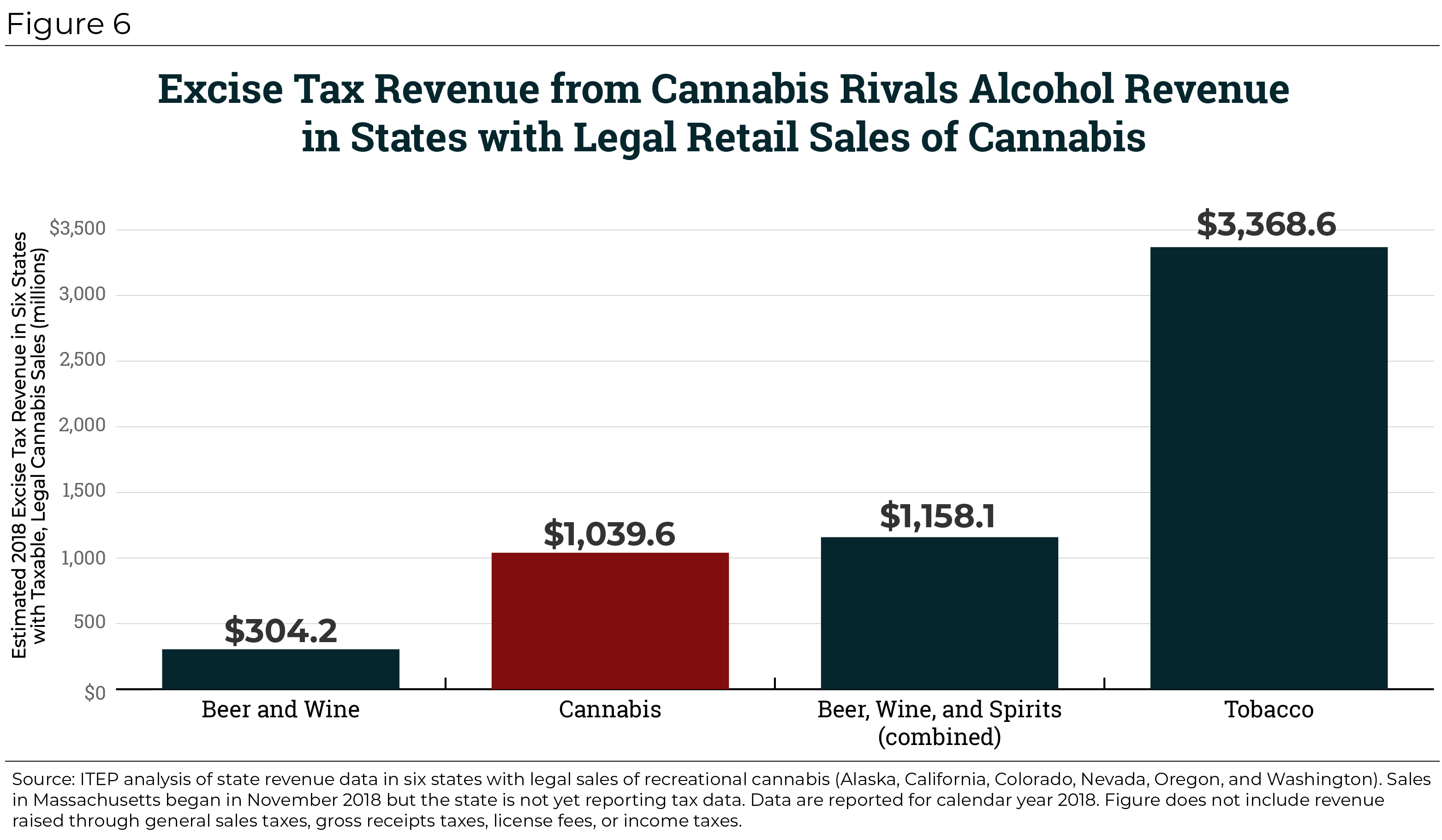

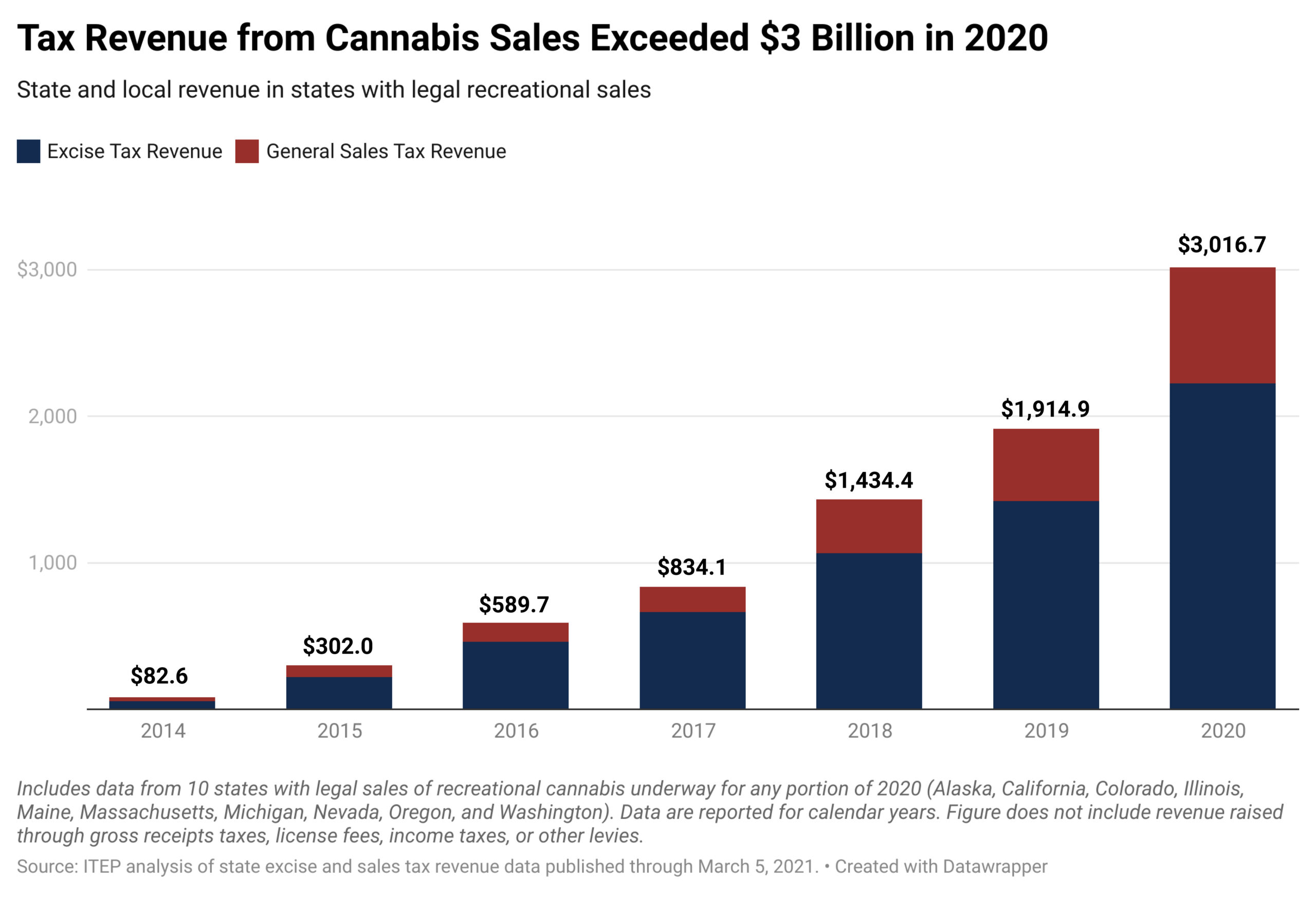

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep